From 1 September 2018, all legal persons entered in the register had to submit a list of beneficial owners within 60 days via the e-business register portal or a notary. New legal entities established from that date must submit the original list of beneficial owners at the time of establishment.

The duty to retain and gather data on the beneficial owner, which enters into force on 1 September 2018, originates from chapter 9 of the Money Laundering and Terrorist Financing Prevention Act.

Pursuant to the Act, a legal person in private law is required to retain and gather relevant, accurate and up-to-date data on its beneficial owners, including information on its right of ownership or other manners of exercising control.

Identification of beneficial owners has thus far been required of credit and financial institutions, notaries and other obligated persons in establishing a business relationship or conducting transactions. Pursuant to the provisions of the Money Laundering and Terrorist Financing Prevention Act, which enter into force of 1 September, legal persons in private law are required to make their beneficial owners public via the commercial register. To this end, shareholders or members of an association must provide the management board with information about beneficial owners. After that, the management board submits the data via the E-Business Register or through a notary.

Read more: Guidelines how to determine beneficial owners

By logging in to the e-Business Register, the person entitled to represent the association can submit the data of the beneficial owners of the association.

To do this, press the "Dashboard" button on the home page after logging in.

In the list of related legal persons that opens, click on the name of the legal person whose beneficial owners are to be determined.

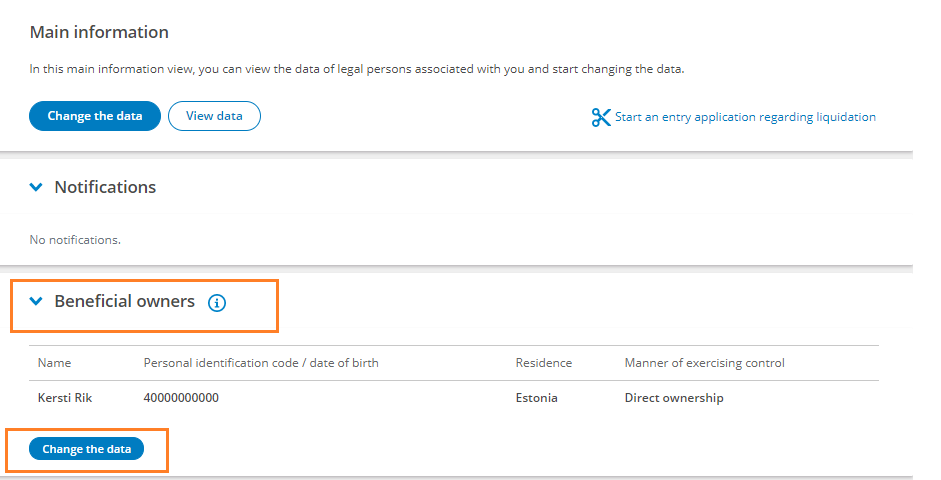

The page that opens shows the main information about the legal entity, click on "Beneficial owners" section where you can see the list of current beneficial owners, where it is possible to add, change and remove persons by clicking the "Change the data" button.

The editing view opens, where you can add new beneficial owners and delete or edit the details of existing beneficial owners.

When adding, information on the name of the beneficial owner, personal identification code, country of residence and the manner of exercising control must be filled in. (If the person does not have an Estonian personal identification code, you can add information about another country and fill in either the personal identification code or the date of birth field.)

.

When deleting the beneficial owner, the reason for the deletion must also be included, choosing either:

- the removal is made because the person was wrongly designated as the beneficial owner. In this case, the details of this person will not be displayed in the list of beneficial owners.

- the removal is made because the person is no longer the beneficial owner. In this case, the person will later appear in the historical data of the beneficial owners.

The portal does not allow the deletion of all beneficial owners; when deleting all previous beneficial owners, new beneficial owners must also be added.

After making all the necessary changes, click "Next" to check that all changes are correct and then submit the changes.

The application for change of beneficial owners will not require signing or a state fee. Changes to the legal entity's data will be made automatically and immediately after submission to the beneficial owners data.

FAQ

1. Who are required to submit data?

Data must be submitted by companies, non-profit associations and foundations

2. Who are not required to submit data?

Data is not required to be submitted by:

- sole proprietors;

- apartment associations;

- building associations;

- companies listed on a regulated market that are subject to disclosure requirements consistent with European Union law or subject to equivalent international standards, which ensure adequate transparency of ownership information;

- foundations the purpose of whose economic activities is the keeping or accumulating of the property of the beneficiaries or the circle of beneficiaries specified in the articles of association and who have no other economic activities.

Of the aforementioned, foundations must themselves state on the page for designating Beneficial owners that there is no legal requirement for them to submit the data of beneficial owners.

For apartment associations, building associations and listed companies, the portal automatically identifies that there is no requirement to submit the data of beneficial owners and the association also does not have the opportunity to do so in the e-Business Register Portal.

3. How can one access the data of beneficial owners?

Everyone can access the data in the e-Business Register immediately after the data has been submitted.

You can find more detailed instructions for accessing the data here.

4. How can one specify the data of beneficial owners during establishment?

Currently, it is not possible to determine beneficial owners in the initial entry application. Thus, one must wait until the registrar has entered the association into the register and, after that, submit the data of the beneficial owners of the association.

5. How often does the data need to be updated?

If the details of the beneficial owners have not changed, this will be confirmed annually during the submission of the annual report.

If the data has changed, the updated information must be submitted immediately on the e-business register portal.

6. Who are the actual beneficiaries of the non-profit association (MTÜ)?

According to the instructions of the Ministry of Finance:

The beneficial owner must also be indicated in the case of non-profit organizations, although none of them is intended to make a profit.

In this case, according to the definition of the beneficial owner, the person(s) under whose control the association operates are indicated. This usually means board members.

Exceptions are possible, for example, if the founders or members of a non-profit association are legal persons: in this case, the beneficial owner is determined in the same way as in the case of companies. Here, too, the principle applies that in the case of a board of more than four members, it is sufficient to appoint the chairman of the board.

If a person is designated as the beneficial owner because of his or her position as a member of the management body, it shall not be considered that he or she receives financial income from the association or that the association acts in his or her personal interests.

Read more:

Instructions about confirming the accuracy of actual beneficiaries (in case of discrepancy notices)

instructions for viewing the details of the beneficial owners of legal persons